As a real estate investor, it’s important to remember that profitable deals are not about property. While purchasing the right asset at the right time is essential, capital structure is critical to success.

Download the FREE Illustration HERE:

Real Estate Investing Is Not Only About Property

As a real estate investor, it’s important to remember real estate deals are not about property. While purchasing the right asset at the right time is essential, capital structure is critical to success. What is capital structure, and how does it affect you as a real estate investor?

Capital structure is the combination of debt and equity used to finance a real estate deal. Equity refers to the amount of money you put into the deal. To learn more about the importance of achieving the right balance between equity and debt, make sure to catch George Antone’s explanation here:

Tuning Into Success as a Real Estate Investor

Putting together a real estate deal is like tuning an old radio set.

When your grandparents wanted to listen to a specific radio show, they needed to know the correct time, channel number, and frequency. A few minutes before the scheduled airtime, they would use the controllers on the radio to carefully tune into the channel to get a clear reception.

As a real estate investor, there is some information you need to know before committing to a deal. It would be best if you also fine-tuned your ‘dials or levers to ensure you achieve clarity.

George identifies these levers as follows:

Lever 1: Loan-to-Value (LTV) Ratio

The first lever is the Loan-to-Value (LTV) ratio. This critical aspect of the capital structure involves balancing debt and equity in your investment. George Antone suggests increasing or decreasing the debt percentage can significantly influence a deal’s outcome.

Lever 2: Spread Between Cap Rate and Loan Constant

The second lever involves the spread between the capitalization rate (cap rate) and the loan constant. A positive spread, where the cap rate exceeds the loan constant, indicates a profitable investment. Overlooking the spread could lead to significantly miscalculating the profitability of your deal over the long term.

Lever 3: Reserves Management

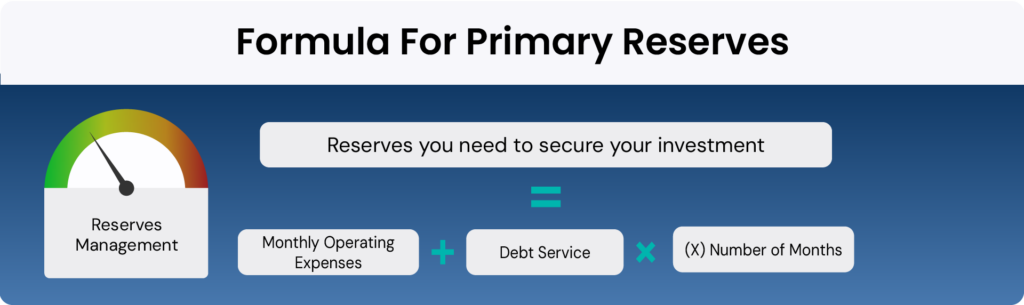

The third lever is about ensuring you have reserves. In the tutorial, George uses a simple formula for primary reserves:

Having the proper reserves ensures you have a safety net for your investment.

To apply these levers, George suggests starting with a positive spread, adjusting the LTV to an optimal level, and ensuring adequate reserves. This approach provides a balanced and strategic method for real estate investing.

Overcoming the Complexity

Fortunately, the shift from analog to digital broadcasting means you never have to manually tune into a radio station to catch your favorite shows. The same is fortunately true for your real estate investors.

Understanding the fundamental principles that govern your wealth-building journey will ensure you can identify the ‘levers’ you need to tune to ensure a successful outcome. The actual tuning of those levers can be managed by innovative technology, such as our IRIS program.

At Fynanc, we help real estate investors achieve exponential financial growth to achieve their desired lifestyle faster and safer through the power of technology.

If you are ready to achieve your financial goals faster, safer, and with more certainty, join us for our upcoming workshop: