Many investors unknowingly hinder their financial growth by failing to recognize critical principles.

This blog explores solutions to the Profit Fallacy while reinforcing foundational wealth-building strategies.

Download the FREE illustration here:

What Is the Profit Fallacy?

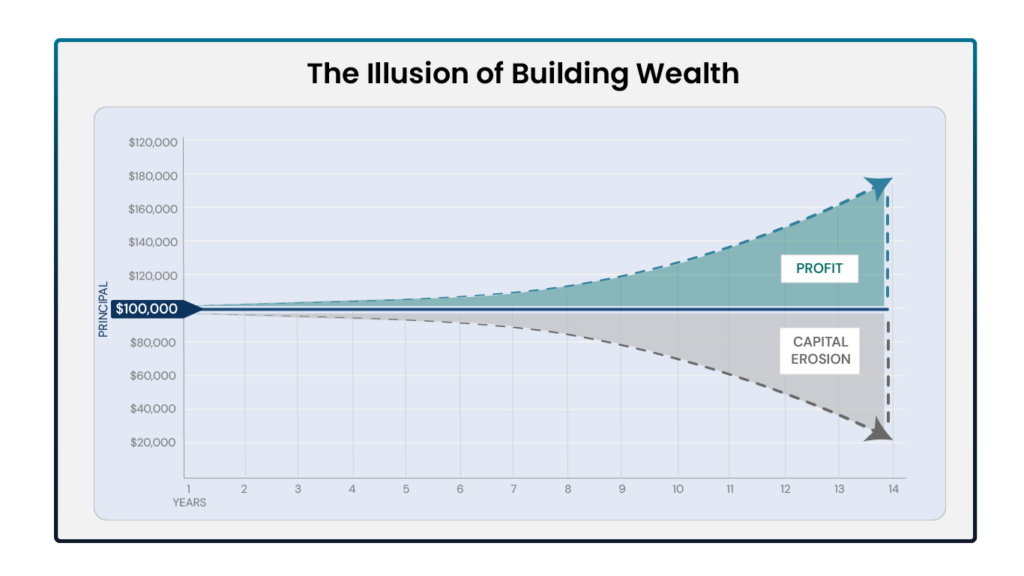

The Profit Fallacy occurs when investors focus solely on their profits without accounting for the erosive impact of inflation on their principal investment. While their accounts may show gains, the real purchasing power of their money is quietly eroding.

Why is the Profit Fallacy an invisible trap?

Imagine you invest $100,000, expecting substantial returns. Your $100,000 represents your principal, while any profit symbolizes your financial growth, whether through real estate, private lending, stocks, or other avenues.

Years later, you receive your $100,000 back plus $30,000 in profit. At first glance, this seems like a win. But here’s the problem:

Profit vs. Purchasing Power

When you made your investment, $1 bought one cup of coffee, meaning your $100,000 could purchase 100,000 cups of coffee. Fast forward several years, and inflation raises the price of coffee to $1.30 per cup.

Now, your $100,000 can only buy 77,000 cups of coffee. Adding your $30,000 profit, you can purchase 100,000 cups—just breaking even.

However, taxes on your $30,000 profit mean your total purchasing power decreases even further. Despite your apparent gains, you’re moving backward financially.

The Solution: Sharing Profits and Leveraging Strategic Debt

To escape the Profit Fallacy, George Antone proposes two innovative strategies:

1. Sharing Profits with a Partner

Instead of shouldering the full burden of inflation, share profits with a partner. By doing so, you can reduce the depreciation of your principal and preserve your purchasing power over time.

2. Using Strategic Debt

Borrowing funds for investments allows you to:

- Use other people’s money (OPM) to protect your capital.

- Pay a small amount of interest while reaping significant profits.

By shifting the inflationary burden to the lender, you can stabilize your initial capital and grow wealth sustainably.

How to Escape the Profit Fallacy

Avoiding the Profit Fallacy requires deliberate strategies. Here are three essential steps:

1. Structure Your Deals Intelligently

Many investors focus solely on acquiring assets but neglect the financing structure. Proper deal structuring can optimize profits and protect your principal from inflationary erosion.

2. Choose the Right Assets

Not all investments are created equal. Selecting the right assets in the correct sequence is critical for financial success.

3. Regularly Rebalance Your Portfolio

Over time, portfolios often become skewed toward certain assets, increasing vulnerability to the Profit Fallacy. Rebalancing ensures diversification and reduces risk.

Avoiding the Trap

The Profit Fallacy highlights the importance of focusing not just on profits but on preserving purchasing power and structuring deals strategically. By sharing profits, leveraging debt, and employing tools like Fynanc’s Amplified Approach, you can build sustainable wealth and avoid falling into financial traps.

Ready to take control of your financial future? Register for our upcoming Wealth Journey Workshop.