What if the secret to reaching your financial goals faster lies in something you learned as early as seventh grade math?

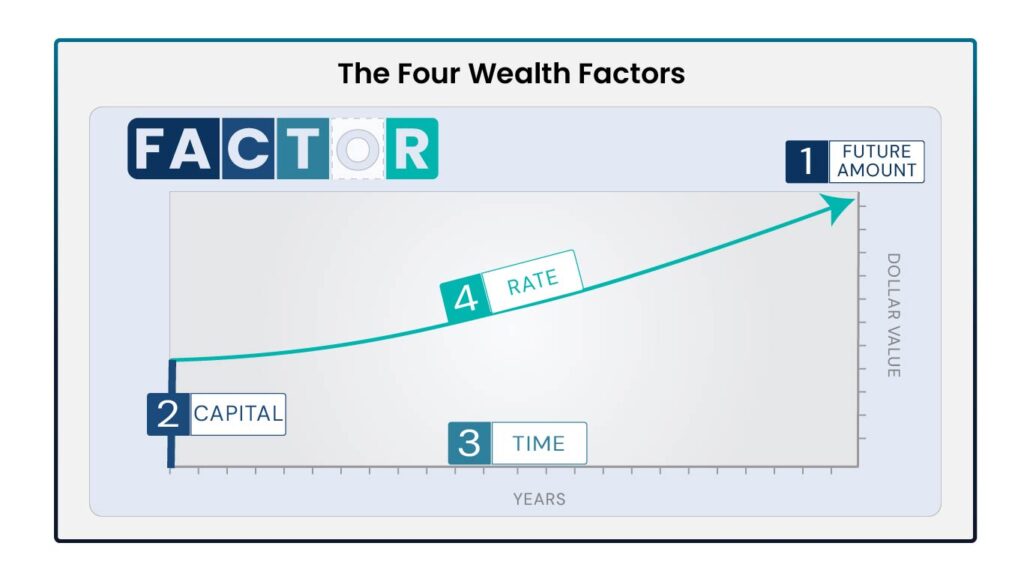

George Anton introduces us to The Four Wealth Factors, a timeless principle that applies to every wealth-building strategy. Whether you invest in real estate, stocks, or any other asset, understanding these factors is crucial to making informed decisions and achieving financial success.

Download the full illustration here:

The Wealth Principle: A Universal Truth

The four wealth factors are not tied to any specific investment or asset. Instead, they form the foundation of wealth-building across all time periods and financial systems. These factors—future amount, capital, time, and rate—are the most important variables that influence your financial journey. George calls this the Wealth Principle, a truth that has held firm for centuries and will continue to do so.

Let’s break these factors down and explore how they interact to shape your financial outcomes.

The Four Wealth Factors:

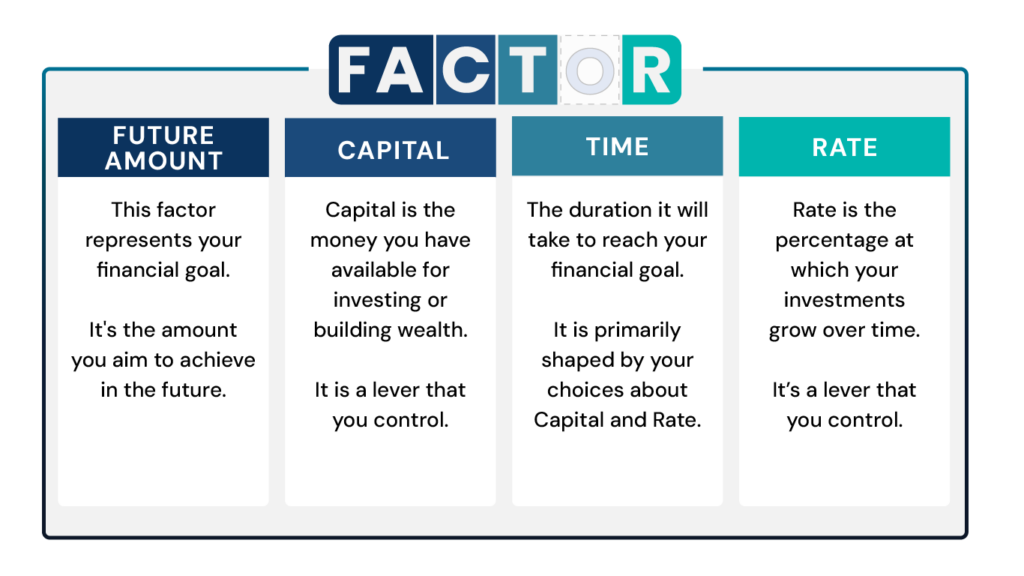

Future Amount:

This is your financial goal—the target amount you want to accumulate by a specific time. Setting this number is the first step in your wealth journey. Whatever that figure is, it’s a decision you make based on your lifestyle aspirations.

Capital:

Capital represents the resources you have available to invest or leverage. It doesn’t necessarily have to be your own money—it can include borrowed funds or other financial tools. Capital is one of the two levers you directly control to influence your wealth-building progress.

Time:

Time refers to the duration of your wealth-building journey. While it may seem like an independent factor, time is actually the result of how effectively you optimize your capital and rate. By making smarter decisions, you can reduce the time needed to reach your goals.

Rate:

Rate refers to the return on your investments. It’s often seen as the key to wealth-building, but focusing too much on rate can be misleading. Inflation, fees, and other factors can erode returns, making rate a secondary consideration to capital during the early phases of wealth accumulation.

The Problem with Prioritizing the Wrong Lever

Out of the four factors, capital and rate are the two levers you can actively control. However, many people mistakenly focus on rate, chasing higher returns while overlooking the importance of increasing their capital base. This common misstep leads to slower progress and a lifetime of unnecessary work.

George emphasizes that capital has the most significant impact on your financial success. By prioritizing decisions that maximize capital—such as leveraging resources or investing in assets that generate equity—you can accelerate your journey toward financial independence.

A Wealth-Building Strategy for Every Phase of Life

The importance of each wealth factor shifts depending on where you are in your financial journey:

During the Accumulation Phase:

Focus primarily on building and leveraging capital. For example, in real estate, using leverage (borrowed capital) allows you to grow your wealth faster compared to solely relying on personal savings or returns.

As You Approach Retirement:

Shift your focus from capital to rate. In this phase, the priority is preserving wealth and generating steady income from your investments. This transition ensures financial stability while minimizing risk.

A Universal Principle for All Investments

The beauty of the Wealth Principle is its universality. Whether you’re investing in real estate, stocks, or other assets, the four factors remain constant. Understanding these principles helps you make smarter decisions that align with your financial goals, regardless of the type of investment.

For instance, when buying stocks, focusing on capital allows you to build a diversified portfolio rather than gambling on high returns from a few speculative picks.

In real estate, leveraging capital to acquire appreciating assets offers a balanced approach that combines growth with financial stability.

The Key Takeaway: Focus on Capital First

George reminds us that while all four factors are important, capital is the foundation of wealth-building. By focusing on capital during the early stages of your journey, you set yourself up for faster progress and greater financial security. As you move closer to your goals, you can shift your attention to optimizing rate to preserve and grow your wealth.

Ready to Transform Your Financial Future?

Understanding and applying the Four Wealth Factors can revolutionize the way you approach your finances. If you’re ready to take the next step, download the free PDF accompanying this lesson for a deeper dive into these principles. You’ll find the link below the video.

At Fynanc, we’re here to help you learn about financial strategies that can make a lasting difference to your financial future. Whether you’re just starting your wealth journey or looking to refine your approach, we’re dedicated to guiding you toward success.

Subscribe to our channel for more life-changing insights, and join our community of wealth-builders who are transforming their financial futures every day.

Remember: One decision, one result, and two levers—that’s all it takes to master the art of wealth-building. Focus on the right factors, and you’ll reach your goals faster than you ever thought possible.