Welcome to the Fynanc Blog, where we dive deep into the world of finance and empower you with the knowledge to achieve your financial goals.

In this article, we explore the importance of adopting a banker’s mindset—a perspective that allows you to reach your goals faster, safer, and with more certainty. Understanding how bankers think can unlock success as an investor, no matter the market conditions.

Understanding The Banker’s Mindset

Most people operate from either a consumer mindset or an investor mindset. Both are focused on assets and acquisitions. But the banker’s mindset shifts the focus entirely to finance, and that’s where real wealth power lies.

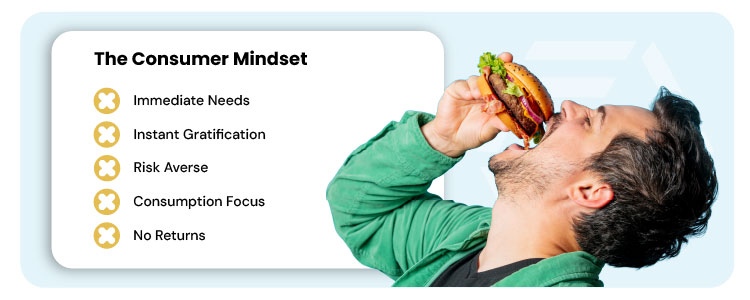

The Consumer Mindset:

- Immediate needs and desires: Consumers focus on satisfying short-term wants.

- Short time horizon: They seek instant gratification rather than long-term outcomes.

- Risk aversion: Safety, affordability, and brand reputation guide decisions.

- Consumption focus: Purchases provide personal satisfaction, convenience, or enjoyment.

- No financial return: Consumers acquire goods for use, not growth.

Key takeaway: Consumers live in an asset-first world, where “stuff” takes priority over financial strategy.

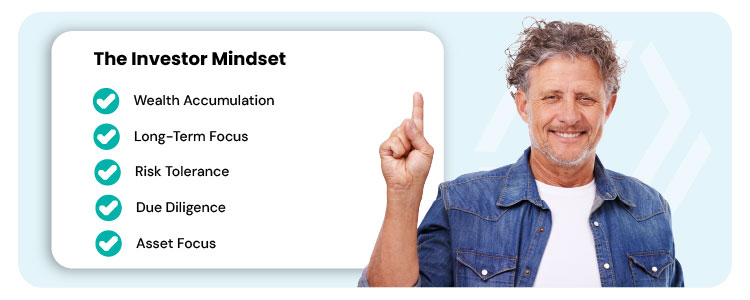

The Investor Mindset:

- Wealth accumulation: Investors aim to grow assets that generate income or appreciate in value.

- Long-term focus: They delay gratification to build wealth over time.

- Risk tolerance: Investors accept calculated risk in pursuit of higher returns.

- Due diligence: Market research and financial analysis are essential.

- Asset focus: Investments in real estate, businesses, or stocks are the pathway to wealth.

Key takeaway: Investors are more strategic than consumers, but they still focus on owning assets rather than on finance itself.

Introducing the Banker’s Mindset

In banking, the saying holds true: “He who has the gold makes the rules.”

But here’s the twist—bankers rarely focus on “stuff.” Instead, they focus on how to leverage the financial system to maximize profits.

The Golden Rule

“He who is perceived to have the gold makes the rules.”

Every dollar has opportunity cost. It can either:

- Earn interest if invested, or

- Lose that potential by being spent or left idle.

Bankers understand this principle better than anyone. They prioritize finance over assets, focusing on:

- Risk management

- Profit maximization

- The velocity of money (keeping money in constant motion)

- Using other people’s money (OPM) to generate returns

Where investors are asset-first, bankers are finance-first.

The Banker’s Mindset vs. The Investor’s Mindset

Focus: Finance vs. Assets

- Investors accumulate assets to build net worth.

- Bankers see assets as collateral and prefer controlling cash flow instead of owning property.

Risk Allocation

- Investors take on higher risk through down payments and leverage.

- Bankers shift risk onto borrowers by requiring equity contributions.

Cash Flow

- Investors often end up asset-rich but cash-poor.

- Bankers maintain both cash and asset security.

Example: Who Holds the Risk?

- Scenario 1: Homeowner buys a $100,000 house with a $20,000 down payment and an $80,000 loan.

- If sold immediately, closing costs eat away much of the down payment.

- Result: The homeowner bears the greater risk.

- Scenario 2: Lender issues a 100% loan (no down payment).

- Borrowers can walk away easily, leaving banks exposed.

- Result: The lender carries the risk.

- Scenario 3: Bank funds a 65% LTV loan.

- They control 100% of the property value for only 65% of the risk.

- Result: The bank is protected.

Bankers master the art of shifting risk away from themselves and onto borrowers.

Why the Banker’s Mindset is About Safety

The cornerstone of banking is safety. Bankers build wealth by:

- Minimizing risk exposure

- Cloning money through spreads and leverage

- Creating wealth via paper transactions instead of managing physical assets

By adopting a banker’s mindset, you move beyond the asset-first world into the finance-first world, where opportunities multiply and risk is managed strategically.

Final Thoughts

The consumer focuses on satisfaction.

The investor focuses on assets.

The banker focuses on finance.

To accelerate your journey toward your financial goals, think like a banker:

- Prioritize finance over assets

- Keep your money in motion

- Shift risk exposure away from yourself

- Leverage the velocity of money

At Fynanc, we help you move beyond the consumer and investor mindset so you can adopt the banker’s mindset—the key to building wealth with greater speed, safety, and certainty.