When you hear the word “interest,” what comes to mind? Is it a positive or negative reaction, or maybe somewhere in between?

George Antone opens our “Understanding Interest” series by challenging you to reflect on how you view interest. It’s important to understand how your perspective can either limit or accelerate your financial journey.

In this series, we’ll delve into the four types of investors and reveal why only one group has truly unlocked the path to wealth-building. So, ask yourself: which group are you in?

Download the FREE illustration here:

Understanding Interest: Earn It or Pay It

“Those who understand interest, earn it. Those who don’t, pay it.”

– Albert Einstein

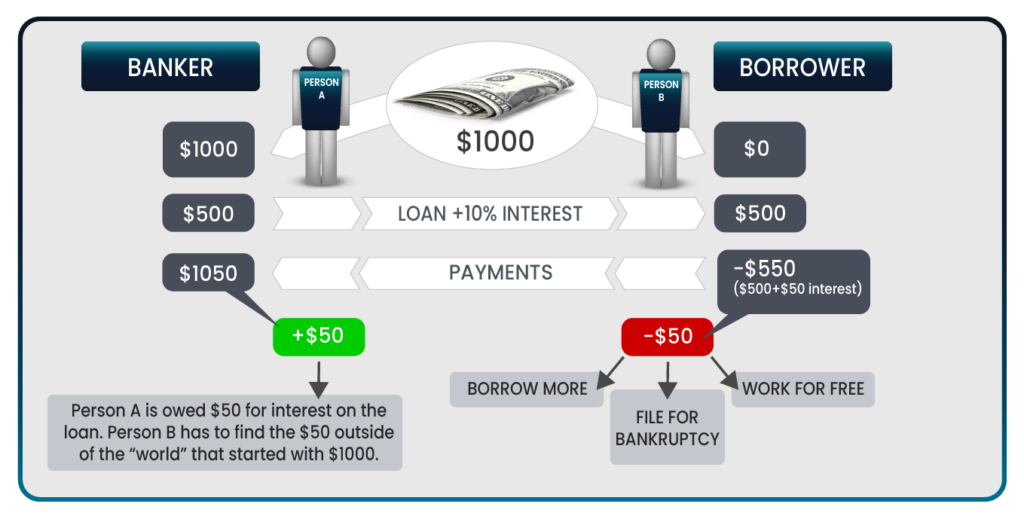

On the surface, the above quote sounds logical. However, there’s much more depth to what Einstein was implying. To illustrate, imagine two people in a closed economy with just $1,000. Person A has all of the money in the system (banker) and person B has none (borrower).

In this scenario, the borrower falls into a debt trap as has only three choices:

- Borrow more – This deepens the debt cycle, with interest piling up.

- File for bankruptcy – An option that may reset the debt but has long-term repercussions.

- Work for free or for less to repay the debt

By charging interest, the lender controls the money flow, placing the borrower at a significant disadvantage. This example sheds light on the reality that, in our financial system, some people are on the paying side, while others benefit by being on the receiving side.

The Financial System: Two Sides, Four Types of Investors

Our financial system is inherently divided into two sides: the paying side and the receiving side. People on the paying side are those who consistently pay out interest, taxes, and other costs. Conversely, those on the receiving side have structured their finances to earn interest, thus building their wealth. However, not everyone sees this dynamic or realizes the long-term impact of which side they’re on.

The four types of investors in relation to interest are:

| Those who pay interest: | Commonly, these are people who borrow without a plan to offset interest costs, leading to financial strain. |

| Those who receive interest: | These are individuals or entities that strategically earn from others’ interest payments. |

| Those who avoid interest: | People in this group often avoid debt entirely, missing out on leverage that could grow their wealth. |

| Those who pass interest on: | Typically, these investors are skilled in managing their debt and income in a way that transfers interest costs to others. |

Avoiding interest may seem like a sound strategy, but it can also be a missed opportunity. Smart, calculated borrowing can help you move to the receiving side, enabling you to earn interest and avoid common financial traps.

Your Position in the Financial System: The Key Question

To truly take control of your financial future, start by asking yourself, “Am I on the paying side or the receiving side of interest?”

The financial system doesn’t offer a third choice. By understanding where you currently stand, you can begin to shift your position if necessary. For many people, moving from the paying side to the receiving side can be transformative, helping them secure a path to financial independence and a stronger financial future.

Next Steps and Resources

This is only the beginning of your journey to mastering interest and understanding its true power. The “Understanding Interest” series dives deeper into these concepts, helping you discover:

- How to identify which group you belong to and make strategic adjustments.

- Why simply avoiding debt isn’t always beneficial and may actually be costing you purchasing power.

By learning how to use interest as a tool, you can avoid becoming a “victim” of the financial system. Our upcoming videos in this series will explore more about how inflation, taxes, and opportunity cost all play into the dynamics of paying versus receiving.

Want More? Join Our Community

We believe in empowering you with knowledge that can change your financial trajectory. Join our workshops, download our resources, and explore more insights to put yourself in a position to earn, rather than pay, interest.

Whether you’re new to these concepts or looking to deepen your financial knowledge, Fynanc is here to support you on your journey to financial happiness.