According to Fidelity Investments’ Annual Resolution Study, almost two-thirds of Americans are considering a financial New Year’s resolution for 2023, which would include saving more money, paying down debt and spending less. But if you’ve ever made a New Year’s resolution, then you know they are not always easy to keep for long. Let’s look at five things you can do to help keep your resolution for getting your finances in order in 2023.

The first step – recognize that attaining financial goals can be a bit tricky

Reaching your financial goals is more than just trying to save more money and doing simple math. It is more complex because money is tied to our emotions. We make decisions about money in split seconds, and then we can rationalize that decision.

Talking about money can be difficult. No one wants to hear someone talk about how well off they are or, on the flip side, how stressed they are about their personal finances. Because talking about money can be awkward, you probably aren’t sharing your financial goals or your struggles in attaining them with peers or colleagues. You might feel like everyone around you has their finances under control except you. However, the reality is that most people are not achieving their financial goals because the financial system is designed to make them fail.

The sad reality is that most of what you learn about personal finances at school, college or from your parents is WRONG. Read about how one of our Fynanc students, Jordan came to the realization that he needed to change the way he looked at money.

The next four steps can help guide you to keep that financial resolution.

Step two – identify and understand your motivation

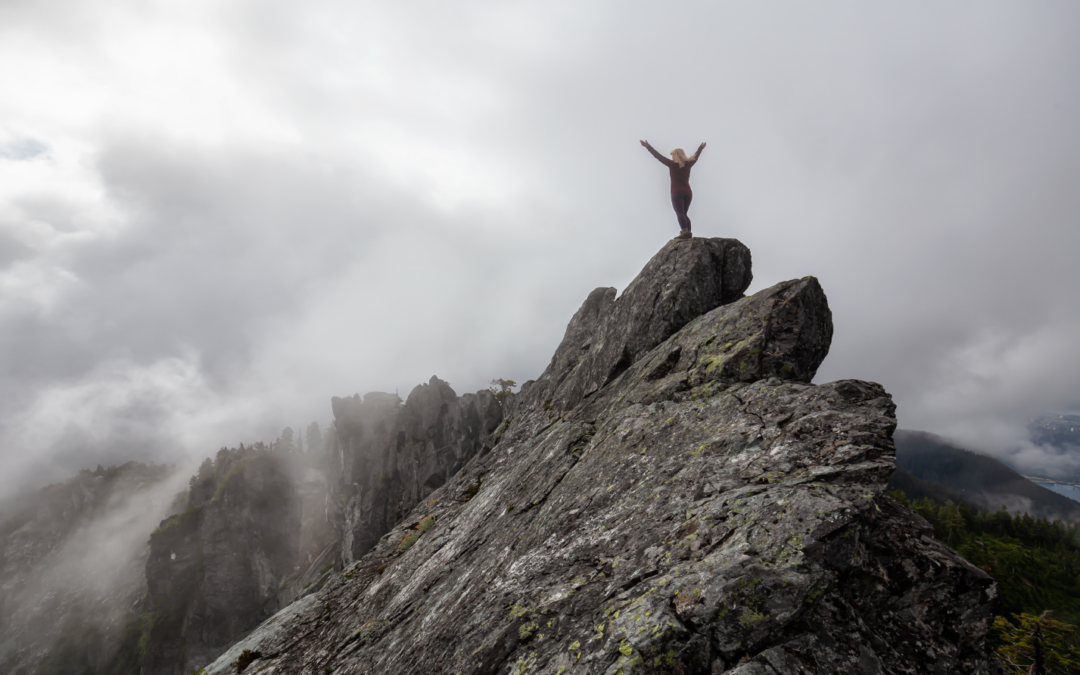

When you are focused on living from day to day, covering your bills and maintaining your standard of living, it’s easy to forget to look at the bigger picture. You need to spend some time reflecting on why improving your personal finances is important to you.

Do you have dreams of retiring early?

Do you want to be able to provide your children with better opportunities than you had?

Would you like to change your career path or make it possible for your spouse to retire early?

Once you have a concrete goal to aim for, it’s easier to reject the illusion of building wealth and adopt more focused and intentional strategies to get you closer to your ultimate goal.

Step three – focus on small improvements

Don’t make your financial resolution too big or too broad, or your goals will seem unattainable, making it easier to simply give up. The key is to be clear on what you are trying to achieve and develop a strategic, step-by-step plan to attain your goals.

If your goal is to reduce your daily expenses to create more room in your budget to invest in your retirement savings, it’s tempting to cut out all the things you enjoy. However, this is a very self-defeating approach that is not very effective. A better approach is to start using your daily expenses as a vehicle to create more passive income. You can learn more about how to turn your expenses into income by reading George Antone’s Income Amplifier Blueprint.

Step four – set yourself up for success

Have you ever started a diet on New Year’s Day with the goal of losing weight and found yourself eating all the holiday treats in the house 24 hours later?

The problem with this approach is that you have not taken the time to set yourself up for success and, therefore, quickly revert to old habits.

The same challenges apply to your financial life. You need to create a supportive environment with access to all the resources you need to make meaningful, lasting changes to your behavior.

If you want to achieve your weight loss and fitness goals in 2023, you will be much more likely to succeed if you visit a dietician, create a customized eating plan that works with your lifestyle, and invest in a fitness smartwatch to help you track your progress using data.

Fynanc is one of the only programs in existence that takes the same approach to your financial well-being, with training, technology, and one-on-one coaching to ensure you are set up for financial success over the short, medium, and long terms.

Step five – anticipate failure and acknowledge your progress

Whenever you start on a new path, it’s tempting to think that one solution or approach is going to solve all your problems. The reality, however, is that failure is one of the most important parts of the learning experience.

If you fail to achieve one of your short-term financial goals, don’t give in to the temptation to give up completely. Shift your focus to the things that are working and learn from the things that are not. Invest in a financial coach that is able to guide you through the learning curbs and accelerate your success to ensure that you are set up for success in 2023.

Learn more about the Amplified Approach: