The path to financial freedom is challenging. For many investors, achieving financial goals can feel like chasing an elusive dream. But what if there were a formula—a secret blueprint—that explains why it’s so difficult? Better yet, what if understanding this formula could give you an edge in reaching your financial objectives faster, safer, and with more certainty?

In this post, we’ll break down the secret formula to help you achieve your financial goals. For a deeper dive, check out the first part of The Secret Formula on our Fynanc YouTube Channel, hosted by George Antone.

A Critical Wealth Principle

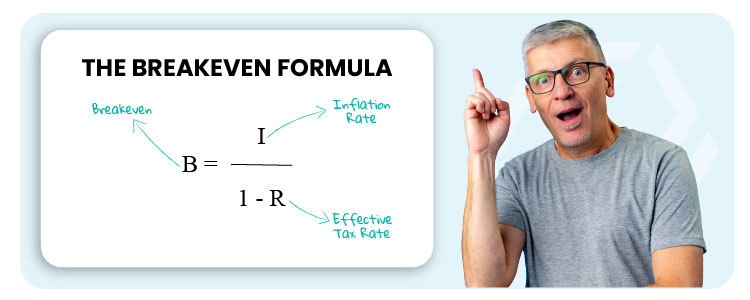

At the core of this discussion lies a fundamental principle of wealth: understanding your breakeven point. Unlike the business term, in this context, breakeven refers to the rate of return your investments need to maintain purchasing power against the twin pressures of inflation and taxes.

The Mathematics Behind It

While math might sound intimidating, this formula simplifies an essential financial truth. Here’s a straightforward explanation:

- R stands for the effective tax rate (ask your accountant for this number).

- I represents the inflation rate.

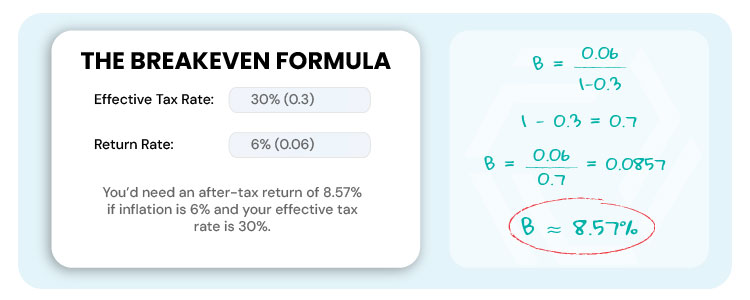

For example, let’s assume:

This means you’d need an annual compounded return of 8.57% just to preserve your purchasing power.

Here’s the kicker: if your returns are 6% or 7%, you’re technically losing purchasing power—even if it looks like you’re “making money.”

The Challenge of Building Wealth

The financial system isn’t built to make wealth-building easy. Many financial advisors and institutions promise returns of 4% to 6%. However, after accounting for fees, taxes, and inflation, your progress might barely scratch the surface—or even move backward.

A Reality Check

Picture this: a cup of coffee costs $1 today. To buy that same coffee in the future as its price rises with inflation, you need to maintain or grow your purchasing power. But if your investments yield only 6% or 7% when you need 8.57%, you’re falling behind. The numbers in your portfolio may grow, but the value of what those numbers can buy shrinks.

The Importance of Diversification

Diversification is key to navigating these challenges. For instance, if half your investments yield low-risk returns of 2%, the other half must work overtime to achieve the necessary overall average. Identifying investment opportunities that deliver consistent, compounded high returns is critical—not just to grow wealth, but to sustain your purchasing power.

The Bottom Line

The financial system is structured to make genuine wealth-building difficult. Even as your portfolio grows, inflation and taxes may silently erode your purchasing power. Recognizing this and understanding the breakeven formula is the first step toward making smarter, more informed investment decisions.

What’s Next?

In our next video, we’ll explore actionable strategies to outperform the system. Remember: making money is important, but retaining purchasing power is just as critical. The two are not the same. Stay informed, stay vigilant, and keep uncovering the principles that govern your financial future.